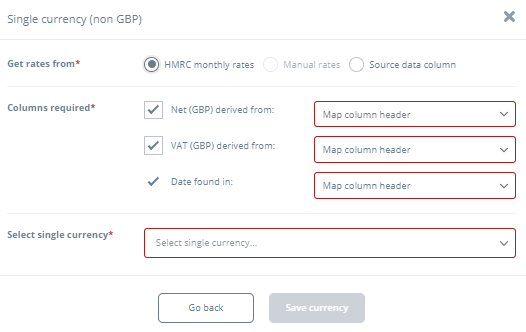

When

you select the HMRC monthly rates

option, a dialog box appear.

The Columns required

section lists relevant data required for the FX conversion

using a single currency. Net (GBP) and VAT (GBP) options appear

with an active check box and will be selected by default.

If you do not require conversion for one of these values then

you can uncheck the relevant box. However, in order to perform

the conversion, you must have one of these selected,

You will need to identify the column header from the

drop down menu that matches each of the items you have selected:

Net (GBP) derived from:

Select the relevant column in your source data that contains

the non-GBP Net values that need converting. VAT (GBP) derived from:

Select the relevant column in your source data that contains

the non-GBP Net values that need converting. Date found in:

Select the relevant column in your source data that contains

the dates for transactions so the correct exchange rate for

each transaction can be applied.

You can now select the single

currency that you need to convert into GBP, from the

drop down list (eg:

USA Dollar (USD). Once you have finished setting up the requirements for

the single currency (non GBP) conversion, click on Save

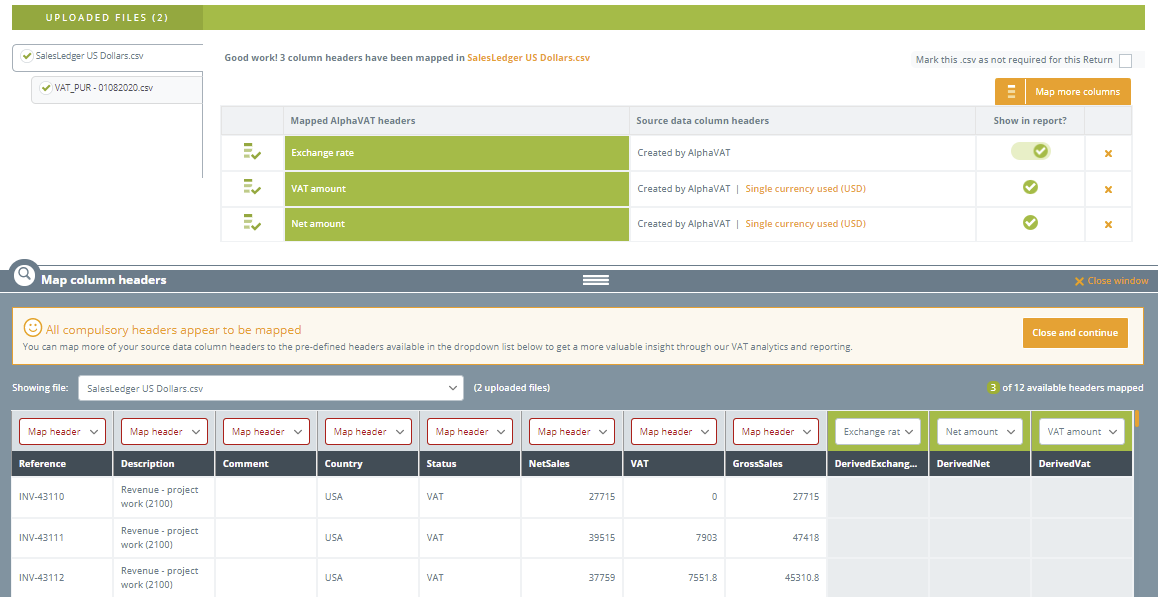

currency button. You will now be taken back to the Map

data tab. You will see that AlphaVAT has added in up

to 3 new columns for the Exchange

rate that it will obtain from HMRC and apply to your

Net and/or VAT

amount columns depending on whether you are converting

one or both of these. Once the conversion is complete, you

will see the converted amounts appear in the Net Amount (DerivedNet) and/or VAT amount (DerivedVAT) columns.

If you have chosen to covert only one of these amounts (i.e.

Net amount), you will need to map the other column yourself

(i.e. VAT amount), since the Net and VAT amount columns are

mandatory and must be mapped in order to process your calculation.

You can now map any other optional headers that you

want. Once you have finished mapping your column headings,

click on the Close and continue

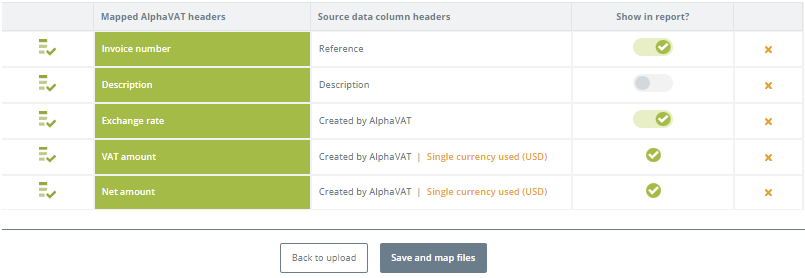

button. You will now see a list of all the headers you

have mapped. For the column headings that you have set

up the FX currency conversion on, you will see the conversion

type description displayed.

AlphaVAT defaults to including all mapped headers in

the VAT calculation reports. But you can use the

toggle in the Show

in report? column for any headers that you do not want

to include in your reports. Once you are finished, click on the Save

and map files button. You can now move onto your other

data files that you have uploaded, to map your column headers

and set up foreign exchange currency conversions where needed. |