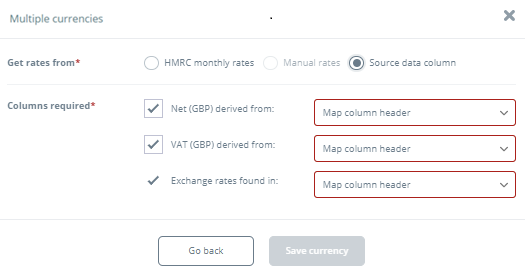

When

you select the Source data column option, a dialog box appear.

The Columns required

section lists relevant data required for the foreign exchange

conversion using a single currency. Net (GBP) and VAT (GBP)

options appear with an active check box and will be selected

by default. If you do not require conversion for one of these

values then you can uncheck the relevant box. However,

in order to perform the conversion, you must have one of these

selected.

You will need to identify the column header from the

drop down menu that matches each of the items you have selected:

Net (GBP) derived from:

Select the relevant column in your source data that contains

the non-GBP Net values that need converting.

VAT (GBP) derived from:

Select the relevant column in your source data that contains

the non-GBP Net values that need converting.

Exchange rates found in:

Select the relevant column in your source data that contains

the exchange rate that should be used to perform the currency

conversion into GBP.

Once you have finished setting up the requirements for

the multiple currencies conversion, click on the Save

currency button.

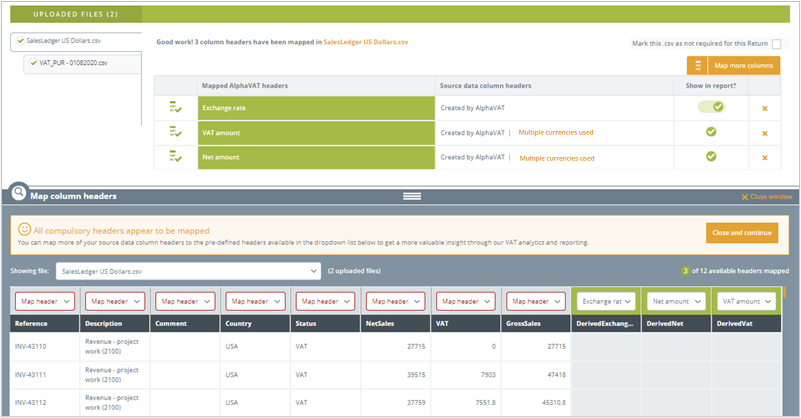

You will now be taken back to the Map data tab. If

you have set up a currency conversion for the VAT amount and

the Net Amount, then you will see that both of these column

headings have also been mapped. These are the mandatory

headers that must be mapped in order to proceed with your

VAT calculation. You may now map further headers to

your data columns if you wish to.

If you only set up a currency conversion for one of the mandatory

headers (either VAT amount or Net amount) then you will need

to map the remaining mandatory header. You can also choose

to map further headers if you wish to.

Once you have finished mapping your column headings,

click on the Close and continue

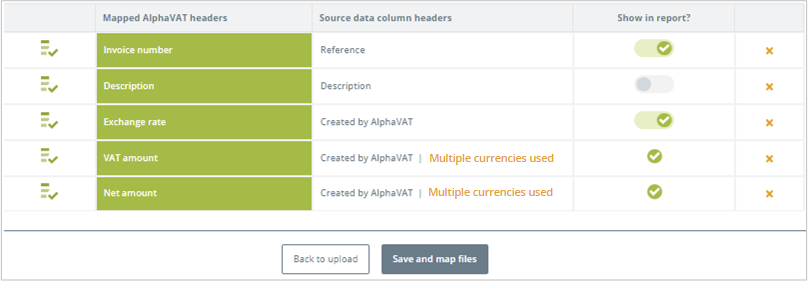

button. You will now see a list of all the headers you have

mapped. For the column headings that you have set up

the FX currency conversion on – you will see the conversion

type description displayed.

AlphaVAT defaults to including all mapped headers in

the VAT calculation reports. But you can use the toggle

in the Show in report?

column for any headers that you do not want to include in

your reports.

Once you are finished, click on the Save

and map files button. You can now move onto any other

data files that you have uploaded, to map your column headers

and set up foreign exchange currency conversions where needed.